#Proof Verification

Explore tagged Tumblr posts

Text

Exploring Fault Proofs in Optimism: An Overview

The activation of fault proofs by Optimism marks a significant advancement in Ethereum Layer 2 scaling solutions, completing the first stage of its decentralization plan. This milestone is pivotal for enhancing the network's security and trustlessness, reducing reliance on centralized entities like the Optimism Security Council. Previously, the council monitored transactions and intervened to prevent fraud, but with the new fault proof system, any party can now challenge transactions, moving towards a more decentralized and inclusive network.

Ethereum's high transaction fees have made Layer 2 scaling solutions, such as rollups, essential. Optimism's fault proofs ensure that off-chain transactions are valid by allowing a challenge period where anyone can contest a transaction's validity. If a challenge is raised, a fault proof is provided and verified by the Ethereum mainnet, ensuring that invalid transactions are reverted.

This process significantly enhances the security and integrity of the blockchain. Unlike Arbitrum, which relies on 12 validators, Optimism's fault proof system is designed to be trustless and decentralized, enabling broader participation in transaction verification.

Despite initial challenges with proof generation and verification speeds, Optimism has optimized its fault proof mechanisms to be compatible with Ethereum's Layer 1. This achievement not only improves the security and decentralization of the network but also sets a benchmark for other rollup technologies.

The activation of fault proofs highlights the importance of continuous innovation and rigorous testing in the blockchain space. For more in-depth insights and exclusive research, join our Web3 Sync community on Intelisync and Learn more...

#Batching Transactions#Challenge Window#Challenges and Criticisms#Criticism Addressed#cryptographic proofs#Decentralization Roadmap#Ethereum Layer 2 scaling solutions#fault proof#fault proof mechanism#Fault Proofs Milestone#Future Outlook#How Optimism Worked Before Fault Proofs#Optimism Achieves a Major Milestone#Optimism Implements Fault Proofs#Optimism’s Decentralization Roadmap#optimistic and zk-rollups#Proof Verification#Reversion of Invalid Transactions#Technical Challenges#The Importance and Issues of Fault Proofs#The Necessity of Layer 2 Scaling#Understanding Fault Proofs in Optimism#blockchain development companies#web3 development#metaverse development company#blockchain development services#metaverse game development#web 3.0 marketing#crypto app development#cryptocurrency development companies

0 notes

Text

hey so watch out if this person ever joins your proship server they just joined mine and spammed this fuckass message 100+ times in every single channel

#profiction#proship#proship safe#proshipper safe#proshippers please interact#antis do not interact#op is a proshipper#proship interact#anti anti#antis dni#worst part is there's a verification system that requires proof and they had convincing enough fake accounts

220 notes

·

View notes

Text

That reminds me of these slides I managed to save from a lecture I've attended this semester on the proof assistant Lean. These include some high profile uses of Lean in proof verification and bunch of resources on learning how to use Lean (including a cool game!!) so check them out!

i dont like how "trust-based" a lot of advanced math is. like, a lot of papers will at various points say "we did this calculation, and got this", (like, two steps in equation manipulation will be related in a very unclear way) and not show you the calculation. and i get it, typing up the calculation is annoying. but often, i will try to replicate the calculation, and will not be able to! and generally i assume this is because i am much worse at math than the author. but like. i guess i just have to take your word for it that the calculation works! this sucks! math isnt supposed to be like this! thats the whole point!

#maths#mathblr#mathematics#math#proof assistant#lean#study materials#proof verification#logic#type theory

374 notes

·

View notes

Text

For those who wanted proof of the military in key cities from this 👇 post.

Here's 👇 one video

This is in New York City... This is not a drill 🤔

#pay attention#educate yourselves#educate yourself#knowledge is power#reeducate yourselves#reeducate yourself#think about it#think for yourselves#think for yourself#do your homework#do your own research#do your research#do some research#ask yourself questions#question everything#military#military operations#proof#verification

188 notes

·

View notes

Text

The fact that I cannot check my work email from home because a year ago a ceo from a different Healthcare system opened an email and clicked a link that allowed for their entire system to be held hostage for like 5 months to the point where they could not even use their telephone lines so now my organization has a two factor identification that does not like my phone and does not work really grinds my gears

#i wrote a paper#i cannot currently access my paper or my email#i need to submit it before i go on pto on Wednesday#and my manager and cns said they would proof it this weekend if it was finished#it is finished i just cant get at it this morning#im probably going to have to drive to work but the outpatient area is locked and i dont know if i can get in#the verification system they had before was so easy to use#i miss it

8 notes

·

View notes

Text

"we are reviewing applications with the support of the DWP. please can YOU provide an original document from the DWP"

just. ask the fucking DWP about it. maybe. perhaps.

#ftr the dwp send one entitlement letter a year. in april#and any time someone wants proof it has to be dated in the last 3 months. last 6 months if you're lucky#so what they're actually asking here is for ME to go ask the DWP for a letter I can then show THEM#pointless middlemanning on my part#when they could just fucking ask themselves#it takes 1-2 weeks for me go get a letter#they could phone and get verification TODAY#but why do that when you can simply foist admin faff directly onto unpaid disabled people instead amirite

25 notes

·

View notes

Note

I'm Caroline from Gaza. Am sorry for sending you this request without your permission. My house was destroyed in the war, and my family lost everything. We've been displaced multiple times, but there's no safe place here. I'm battling Type 1 Diabetes and can't afford insulin, and my mother needs treatment for kidney failure outside Gaza. Any donation, no matter how small, can help us survive and get my mother the care she needs. A friend outside Gaza is helping with the donation program. Please reach out if you need more details.

^ documented scam

#lovingchaosheartladdy#changed urls + names multiple times. on scam warning lists and has no verification or proof of being in gaza that i can find#“please reach out if you need more details” but ignored messages i sent

6 notes

·

View notes

Note

Hello, 🌹🇵🇸🍉

I hope you are well.

Could you please help me reblog the post on my account to save my family from the war in Gaza? 🙏

I am new to Tumblr and also to GoFundMe.🙏

I hope you can support and stand by me at the beginning .

Thank you ♥️ .

---

For my followers, here’s a link to their GFM, please donate if you can or boost their post which I will reblog too.

I wish you and your family well and I hope you all can stay safe. ❤️🖤🤍💚

#fundraiser#I’ve found proof of verification for this account and GFM#so in the wake of all the scams I get sent asks from please help me support a gazan family in need#free palestine

4 notes

·

View notes

Text

Personal Loan Without Guarantor: How to Apply and Get Approved Quickly

Personal loans have become a lifeline for many individuals facing financial crunches. Whether it's for medical emergencies, home renovations, or debt consolidation, a personal loan can offer the financial relief you need. However, many people shy away from applying for a loan because they believe they need to offer collateral or a guarantor. This article will break down the process of applying for a personal loan with no guarantor or collateral, providing you with step-by-step guidance to get a Quick Approval Personal Loan without the usual requirements.

What is a Personal Loan Without a Guarantor or Collateral?

A personal loan without collateral or a guarantor is an unsecured loan. Unlike secured loans, where you need to pledge an asset (like your home or car) or get someone to co-sign, this type of loan does not require any form of security. It’s based entirely on your creditworthiness, income, and repayment capacity. For those who have limited assets or cannot rely on a guarantor, this is the perfect option.

Why Choose a Personal Loan Without Collateral or Guarantor?

No Risk to Assets: Since there’s no collateral involved, you don’t risk losing any of your valuable assets, such as your home or car.

Faster Processing: These loans typically have a quicker approval process because there’s no need for property evaluation or third-party approval.

Flexibility in Usage: Personal loans are versatile. You can use the funds for a variety of purposes, such as medical bills, travel, or home renovation.

Convenience: With the rise of digital banking, you can apply for an Online Personal Loan Application Process and get the funds disbursed to your bank account in no time.

How to Apply for a Personal Loan with No Guarantor or Collateral?

The process of applying for an unsecured personal loan is straightforward, but it’s important to understand the eligibility criteria, required documents, and the application steps.

1. Check Your Eligibility

Before applying, you need to ensure that you meet the basic eligibility criteria. Typically, lenders will check the following:

Age: Most lenders require you to be between 21 and 58 years old.

Income: A steady source of income is crucial. Lenders generally prefer individuals with a monthly income of at least ₹20,000-30,000.

Credit Score: While you don’t need collateral or a guarantor, a good credit score (750 or above) increases your chances of approval for an Instant Cash Loan Disbursal.

Employment Status: You must be either salaried or self-employed. Some lenders may have additional criteria based on your profession or employer.

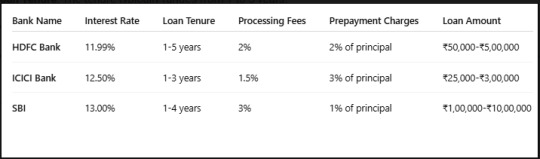

2. Compare Lenders and Loan Offers

It’s crucial to compare different personal loan offers before making a decision. Look for key features such as:

Interest Rates: Personal loans without collateral tend to have higher interest rates compared to secured loans.

Loan Tenure: The tenure typically ranges from 1 to 5 years.

Processing Fees: Some lenders charge processing fees, which could impact the total loan cost.

Prepayment Charges: In case you plan to pay off your loan early, it’s essential to check if there are any prepayment penalties.

You can use comparison tables to easily assess which lender offers the best deal for you.

3. Gather Required Documents

Though you don’t need a guarantor or collateral, you’ll still need to provide certain documents for verification:

Identity Proof: Aadhar card, passport, voter ID, or driver’s license.

Address Proof: Utility bills, Aadhar card, passport, or rental agreement.

Income Proof: Salary slips, bank statements, or IT returns (if self-employed).

Photographs: Passport-sized photos for identity verification.

4. Complete the Online Personal Loan Application Process

Many lenders now offer the ability to apply online. The Online Personal Loan Application Process is simple and quick. You’ll need to fill out an application form, upload your documents, and submit it for processing. Once your loan is processed, you’ll receive an Instant Personal Loan Approval (provided you meet the eligibility criteria).

5. Wait for Approval and Loan Disbursal

Once your application is approved, the lender will process the loan and disburse the funds into your bank account. This could take anywhere from a few hours to a couple of days, depending on the lender. With some lenders offering Fast Insta Loan Approval, you can get the money in your account within the same day or the next.

Key Factors to Consider When Applying for an Unsecured Personal Loan

Interest Rates: Be sure to understand the interest rate and how it will affect your EMIs.

Repayment Flexibility: Choose a lender that offers flexible repayment options.

Loan Limitations: Understand the maximum and minimum loan amounts.

Hidden Fees: Look for hidden fees or charges that could add up during the loan tenure.

Benefits of Taking an Instant Personal Loan with No Guarantor or Collateral

No Risk of Losing Assets: As mentioned earlier, there’s no collateral required, so you won’t risk losing valuable assets like your home or car.

Faster Access to Funds: The application process is much quicker, and many lenders offer Instant Cash Loan Disbursal, ensuring you get funds when you need them the most.

No Need for a Guarantor: You can apply independently without needing someone else to co-sign the loan, making the process more private and straightforward.

Flexible Loan Usage: Personal loans can be used for almost any purpose—medical expenses, home repairs, education fees, and more.

Quick Processing with Minimal Documentation: With minimal paperwork and quick processing times, you can have your loan approved in no time.

5 Frequently Asked Questions (FAQs)

1. Can I get a personal loan with no CIBIL score?

While having no CIBIL score may reduce your chances of approval, some lenders may still offer a personal loan without CIBIL. However, you may face higher interest rates and stricter eligibility criteria. It’s best to check with individual lenders.

2. What is the interest rate on a personal loan with no collateral?

Interest rates on unsecured personal loans are generally higher than those on secured loans. Typically, rates range from 11% to 24% depending on your credit score and the lender's policies.

3. How long does it take to get approved for an unsecured personal loan?

The approval time can vary from lender to lender, but with Fast Insta Loan Approval, you may receive approval within a few hours. Disbursement can take anywhere from a few hours to a couple of days.

4. Do I need a guarantor for a personal loan without collateral?

No, a personal loan without collateral does not require a guarantor. The loan is approved based on your creditworthiness and financial situation.

5. What if I miss a payment on my personal loan?

Missing a payment can affect your credit score negatively. Lenders may charge late payment fees, and repeated missed payments could lead to legal action or the loan being sent to collections.

In conclusion, applying for a personal loan with no guarantor or collateral is entirely possible and often a quick and convenient solution to financial challenges. By following the outlined steps, comparing lenders, and ensuring you meet eligibility requirements, you can secure the funds you need without risking your assets or involving a third party.

#Quick Approval Personal Loan#Online Personal Loan Application Process#Instant Cash Loan Disbursal#Fast Insta Loan Approval#Personal Loan with Bad Credit Score#Unsecured Personal Loan Without Income Verification#How to Apply for Personal Loan in India#Quick Online Personal Loan Approval#Fast Instant Loan Disbursement#Quick Access to Instant Loan Funds#No Income Proof Instant Loan#Unsecured Instant Loan Without CIBIL Score

0 notes

Text

Been a while but

Here is a link to a verified list of Palestinians and their gofoundme donation links!

I decided for myself to reblog/post what I honestly trust.

Reblog whatever you truly believe is legit and donate if you can. In my eyes it is totally right for you to only reblog, post, etc. what you believe is for real. Just remember to not forget them!

The world will not forget 🍉 and one day I hope they will final find peace and the respect they deserve.

#anonymergremlin#really important!#reminder that we need to remember 🍉!#lately i have been tagged so many times and if i am being honest with you i am unsure how to feel about it i believe they are legit#but i also met scammers in the past so i am doing my own thing#look out for legit verifications and other signs to proof it or donate toward legit organizations#but like always if you can't donate it is totally fine i believe rebloging and posting also helps#thank you guys and take care please

0 notes

Text

How to Get an Employment Verification Apostille Online

How to Get an Employment Verification Apostille An employment verification letter (or proof of employment) is an official document confirming an individual’s job details, such as salary, position, and employer information. It’s often required for international purposes, such as applying for jobs abroad, securing housing, or obtaining a mortgage. If you need to use this letter in a foreign…

#salary verification apostille#employment apostille process#Hague Apostille Services#online Apostille service#international document certification#Employment Verification Apostille#notarized employment letter#work verification letter apostille#apostille for proof of employment

0 notes

Text

Just Verified is a reliable employee background verification agency dedicated to providing thorough and accurate verification services for businesses of all sizes. Our team of experts meticulously screens candidates to ensure that employers have all the necessary information to make informed hiring decisions. For more details visit our website:https://justverified.in/

#background verification companies#Employee Background check#background verification employee#employee background verification agency#identity check for employment#id verification service#id proof verification

0 notes

Note

Hello my dears! I, shady ashour, ask you to support my campaign to help me reach my goal. 🙏 I am now in desperate need of your support to help me stay alive and safe. Gaza is a very dangerous place, both in terms of living standards and souls. I need your financial support so that I can get the basic needs of my family. Please help a family survive through your small donations or through your shares to others. And reblog. The campaign is going very slowly. 🙏🍉💔 This donation drive was verified by: @90-ghost

@el-shab-hussein @nabulsi

https://www.gofundme.com/f/help-shady-samir-ashour

post link:

fundraiser link:

0 notes

Text

🔍✨ The key to thriving in business? Validation of your ideas! 💡 Ensure your concepts align with market needs for true success in entrepreneurship. 🚀🔑

#Business idea validation#Entrepreneurial success#Market research#Idea testing#Customer feedback#Business planning#Startup validation#Risk mitigation#Proof of concept#Sustainable growth#Product-market fit#Business model validation#Innovation strategy#Competitive analysis#Market demand verification

0 notes

Text

Opinion Here’s how to get free Paxlovid as many times as you need it

When the public health emergency around covid-19 ended, vaccines and treatments became commercial products, meaning companies could charge for them as they do other pharmaceuticals. Paxlovid, the highly effective antiviral pill that can prevent covid from becoming severe, now has a list price of nearly $1,400 for a five-day treatment course.

Thanks to an innovative agreement between the Biden administration and the drug’s manufacturer, Pfizer, Americans can still access the medication free or at very low cost through a program called Paxcess. The problem is that too few people — including pharmacists — are aware of it.

I learned of Paxcess only after readers wrote that pharmacies were charging them hundreds of dollars — or even the full list price — to fill their Paxlovid prescription. This shouldn’t be happening. A representative from Pfizer, which runs the program, explained to me that patients on Medicare and Medicaid or who are uninsured should get free Paxlovid. They need to sign up by going to paxlovid.iassist.com or by calling 877-219-7225. “We wanted to make enrollment as easy and as quick as possible,” the representative said.

Indeed, the process is straightforward. I clicked through the web form myself, and there are only three sets of information required. Patients first enter their name, date of birth and address. They then input their prescriber’s name and address and select their insurance type.

All this should take less than five minutes and can be done at home or at the pharmacy. A physician or pharmacist can fill it out on behalf of the patient, too. Importantly, this form does not ask for medical history, proof of a positive coronavirus test, income verification, citizenship status or other potentially sensitive and time-consuming information.

But there is one key requirement people need to be aware of: Patients must have a prescription for Paxlovid to start the enrollment process. It is not possible to pre-enroll. (Though, in a sense, people on Medicare or Medicaid are already pre-enrolled.)

Once the questionnaire is complete, the website generates a voucher within seconds. People can print it or email it themselves, and then they can exchange it for a free course of Paxlovid at most pharmacies.

Pfizer’s representative tells me that more than 57,000 pharmacies are contracted to participate in this program, including major chain drugstores such as CVS and Walgreens and large retail chains such as Walmart, Kroger and Costco. For those unable to go in person, a mail-order option is available, too.

The program works a little differently for patients with commercial insurance. Some insurance plans already cover Paxlovid without a co-pay. Anyone who is told there will be a charge should sign up for Paxcess, which would further bring down their co-pay and might even cover the entire cost.

Several readers have attested that Paxcess’s process was fast and seamless. I was also glad to learn that there is basically no limit to the number of times someone could use it. A person who contracts the coronavirus three times in a year could access Paxlovid free or at low cost each time.

Unfortunately, readers informed me of one major glitch: Though the Paxcess voucher is honored when presented, some pharmacies are not offering the program proactively. As a result, many patients are still being charged high co-pays even if they could have gotten the medication at no cost.

This is incredibly frustrating. However, after interviewing multiple people involved in the process, including representatives of major pharmacy chains and Biden administration officials, I believe everyone is sincere in trying to make things right. As we saw in the early days of the coronavirus vaccine rollout, it’s hard to get a new program off the ground. Policies that look good on paper run into multiple barriers during implementation.

Those involved are actively identifying and addressing these problems. For instance, a Walgreens representative explained to me that in addition to educating pharmacists and pharmacy techs about the program, the company learned it also had to make system changes to account for a different workflow. Normally, when pharmacists process a prescription, they inform patients of the co-pay and dispense the medication. But with Paxlovid, the system needs to stop them if there is a co-pay, so they can prompt patients to sign up for Paxcess.

Here is where patients and consumers must take a proactive role. That might not feel fair; after all, if someone is ill, people expect that the system will work to help them. But that’s not our reality. While pharmacies work to fix their system glitches, patients need to be their own best advocates. That means signing up for Paxcess as soon as they receive a Paxlovid prescription and helping spread the word so that others can get the antiviral at little or no cost, too.

{source}

29K notes

·

View notes

Note

Hello, I am Abdul. I ask for your help so that I can buy the simplest necessities of life, such as food and drink. I have a daughter who drinks milk. I do not have money. I hope that my friends will save my little girl.https://gofund.me/f285fe86

Please donate and share to help this person and his family!

#i cant find proof of verification for this fundraiser but i would rather not ignore them. let me know if there is any#free palestine#palestine fundraiser

0 notes